Charitable Trust Filing Requirements Calculator

Enter Your Trust's Financial Information

This tool helps determine whether your charitable trust must file a tax return and which form to use.

Filing Recommendation

Key Takeaways

- Most charitable trusts must file an IRS information return each year.

- Filing form depends on gross receipts and total assets.

- Failure to file can trigger penalties, loss of tax‑exempt status, and state sanctions.

- Simple trusts may qualify for the free Form 990‑N e‑Postcard.

- Timely, accurate filing protects the trust and its donors.

When you set up a Charitable Trust is a legal arrangement that holds assets for charitable purposes, usually overseen by trustees, the IRS automatically assumes you’re an exempt organization. That exemption, however, comes with a paperwork habit: a yearly tax return. If you’re wondering whether your trust has to file, what form to use, and how to avoid costly mistakes, you’re in the right place.

When Does a Charitable Trust Need to File?

All trusts that are recognized as tax‑exempt under IRC §501(c)(3) are considered Tax‑Exempt Organization. The IRS requires an annual information return unless the trust meets one of the narrow exceptions:

- It has no more than $5,000 in gross receipts for the entire year.

- It is a private foundation that files Form 990‑PF (mandatory regardless of size).

- It is a non‑operating charitable trust whose only activity is to hold and distribute funds, and it qualifies for the Form 990‑N e‑Postcard.

If your trust exceeds $5,000 in annual receipts, you’ll need to file one of the standard information returns.

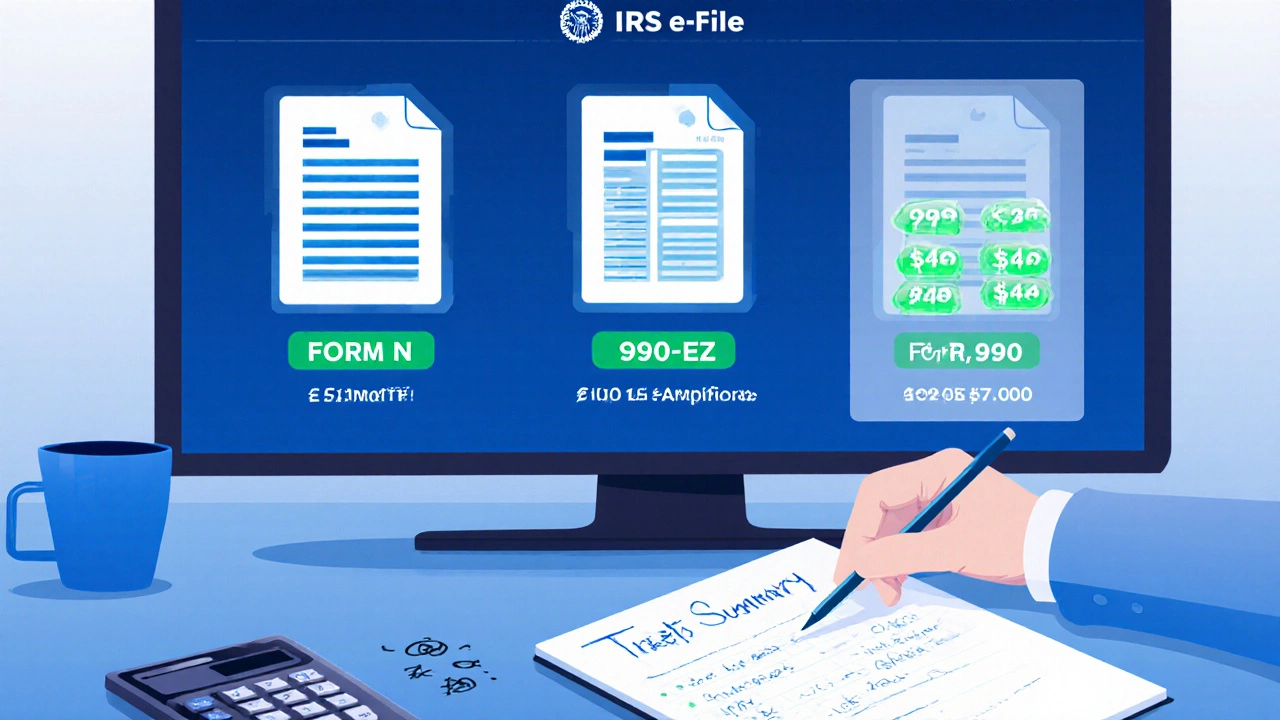

Which IRS Form Should You Use?

The IRS offers four primary forms for exempt entities. Picking the right one hinges on two numbers: total assets at the end of the year and average gross receipts.

| Form | When to Use | Asset Threshold | Gross Receipts Threshold |

|---|---|---|---|

| Form 990‑N | Annual e‑Postcard for very small organizations | Any | ≤ $5,000 |

| Form 990‑EZ | Streamlined return for midsize trusts | ≤ $200,000 | ≤ $200,000 |

| Form 990 | Full information return for larger trusts | > $200,000 | > $200,000 |

| Form 990‑PF | All private foundations (regardless of size) | Any | Any |

Notice how the thresholds line up; if your trust’s receipts hover around $190,000, you’ll file Form 990‑EZ, but a slight jump pushes you into the full Form 990.

How to Prepare and File Your Return

Filing isn’t rocket science, but it does demand attention to detail. Follow these steps to keep things smooth:

- Gather financial data. Pull bank statements, donation receipts, grant awards, and expense reports for the calendar year.

- Determine the correct form. Use the table above or the IRS “Form 990‑EZ vs 990” calculator on the agency’s website.

- Complete the form. Most trusts use tax‑preparation software that outputs the appropriate PDF. Fill in sections on revenue, program services, fundraising, and governance.

- Attach required schedules. For example, Schedule A (public support) and Schedule B (contributors) are mandatory for most charitable trusts.

- Sign and date. The trustee(s) must sign; if you have a paid preparer, they also sign on a separate page.

- File electronically. The IRS requires e‑filing for Form 990, 990‑EZ, and 990‑PF. The free IRS e‑File System handles Form 990‑N.

- Keep a copy. Store the filed return and all supporting documents for at least three years.

Remember, the filing deadline is the 15th day of the 5th month after your fiscal year ends (often May15for calendar‑year trusts). If you need extra time, submit Form 8868 for an automatic six‑month extension.

What Happens If You Miss the Deadline?

The IRS doesn’t take missed filings lightly. Penalties start at $20 per day, multiplied by the number of days late, up to a $10,000 maximum for small trusts. For larger trusts or private foundations, the cap can reach $50,000. Persistent non‑filers risk automatic revocation of tax‑exempt status, which means donors lose their deduction benefits.

State authorities may also impose separate penalties. Many states require an annual charity registration; failure to file both federal and state returns can trigger fines, suspension of fundraising privileges, and even legal action against trustees.

State Reporting Requirements

While the focus here is the federal return, don’t forget the state angle. Most states ask charities to submit a copy of the federal Form 990 (or a summary) and may require a separate state-specific form. For example:

- California. Requires the CHARITY ONLINE portal filing, plus a copy of the Form 990.

- New York. Demands a NY Charities Bureau registration and annual financial statement.

- Texas. Uses the TexasCharities portal; only exempt organizations with > $100,000 in revenue need to file.

Check your state’s Attorney General or Secretary of State website for exact thresholds and deadlines.

Best Practices for Trustees

- Set up a calendar. Mark federal and state filing dates a month in advance.

- Maintain clean books year‑round. Use accounting software that separates program, fundraising, and administrative expenses.

- Document public support. Keep records of donations, grants, and membership fees to prove the 33% public support test.

- Engage a qualified preparer. A CPA familiar with nonprofit tax law can spot errors that trigger audits.

- Review the return before filing. Trustees should verify that the narrative sections accurately reflect the trust’s mission and activities.

Following these habits cuts down on surprise penalties and keeps your trust in good standing with the IRS.

Frequently Asked Questions

Do all charitable trusts have to file a tax return?

Only trusts with more than $5,000 in annual gross receipts must file a full return. Smaller trusts can qualify for the free Form 990‑N e‑Postcard.

What’s the difference between Form 990‑EZ and Form 990?

Form 990‑EZ is a shorter version for organizations with less than $200,000 in assets and receipts. Form 990 is the full, detailed return required for larger trusts.

Can a charitable trust lose its tax‑exempt status for a late filing?

Yes. If a trust fails to file for three consecutive years, the IRS automatically revokes its exemption, and donors lose deduction eligibility.

Do private foundations file a different form?

All private foundations, regardless of size, file Form 990‑PF, which includes additional schedules about investments and payouts.

How can I request an extension?

Submit Form 8868 before the original deadline. The extension gives you six extra months to file, but any tax owed must still be paid by the original due date.

Understanding whether your charitable trust needs to file, and mastering the process, protects the mission you care about. The charitable trust tax return isn’t a hassle-it’s a safeguard for donors, trustees, and the public good.