Charitable Trust Impact Calculator

See how your donation could create lasting change through a charitable trust. Enter your donation amount and spending rate to see how long your impact will last.

How this works:

The calculator shows how a charitable trust could sustain your impact over time. A typical trust spends 4-6% of assets annually to maintain the principal for future generations. Your donation would generate income (e.g., from investments) while preserving the original amount for future causes.

Remember: A properly structured charitable trust can fund causes for decades or even centuries. As the article explains, "It's not about tax breaks alone. It's about legacy, control, and peace of mind."

People don’t set up charitable trusts because it sounds impressive. They do it because it works-quietly, permanently, and exactly the way they want it to. If you’ve ever wondered why someone would tie up their money in a legal structure instead of just writing a check, the answer isn’t about tax breaks alone. It’s about legacy, control, and peace of mind.

They want their money to last longer than they do

A charitable trust isn’t a one-time donation. It’s a long-term engine. Someone might give $50,000 to a local food bank this year. But if they put that same $50,000 into a charitable trust, the money keeps working. The trust invests it. The interest or dividends fund programs year after year. Some trusts last 50, 100, even 200 years. That’s not generosity-it’s sustainability. In New Zealand, trusts like the Charitable Trust a legal structure that holds assets to benefit charitable causes, managed by trustees according to the donor’s wishes set up by farmers in Hawke’s Bay still fund rural education scholarships today, decades after the original donor passed away.

They want to control how the money is used

Writing a check to a charity means handing over control. The charity decides how to spend it. A charitable trust changes that. The donor writes the rules. Maybe they want the money to go only to mental health services for veterans. Or only to native tree planting in the South Island. Or only to scholarships for Māori students studying environmental science. The trust document locks that in. No board vote. No fundraising pressure. No shifting priorities. If the charity changes its mission, the trust keeps going exactly as planned. That level of precision matters to people who’ve spent years working in a specific field and know exactly what works.

They’re protecting their estate-and their family

Many people set up charitable trusts as part of estate planning. It’s not about avoiding taxes-it’s about avoiding chaos. Without a plan, an estate can get tied up in probate for months or years. Legal fees eat into what’s left. Family members fight over assets. A charitable trust bypasses most of that. Assets go directly into the trust, managed by named trustees, and distributed according to clear instructions. It’s cleaner. Quieter. Less stressful for everyone involved. And here’s the quiet truth: people often include family members as trustees-not because they’re handing them control, but because they want them to understand the purpose. It becomes a family legacy, not just a financial transaction.

They want to give in a way that feels personal

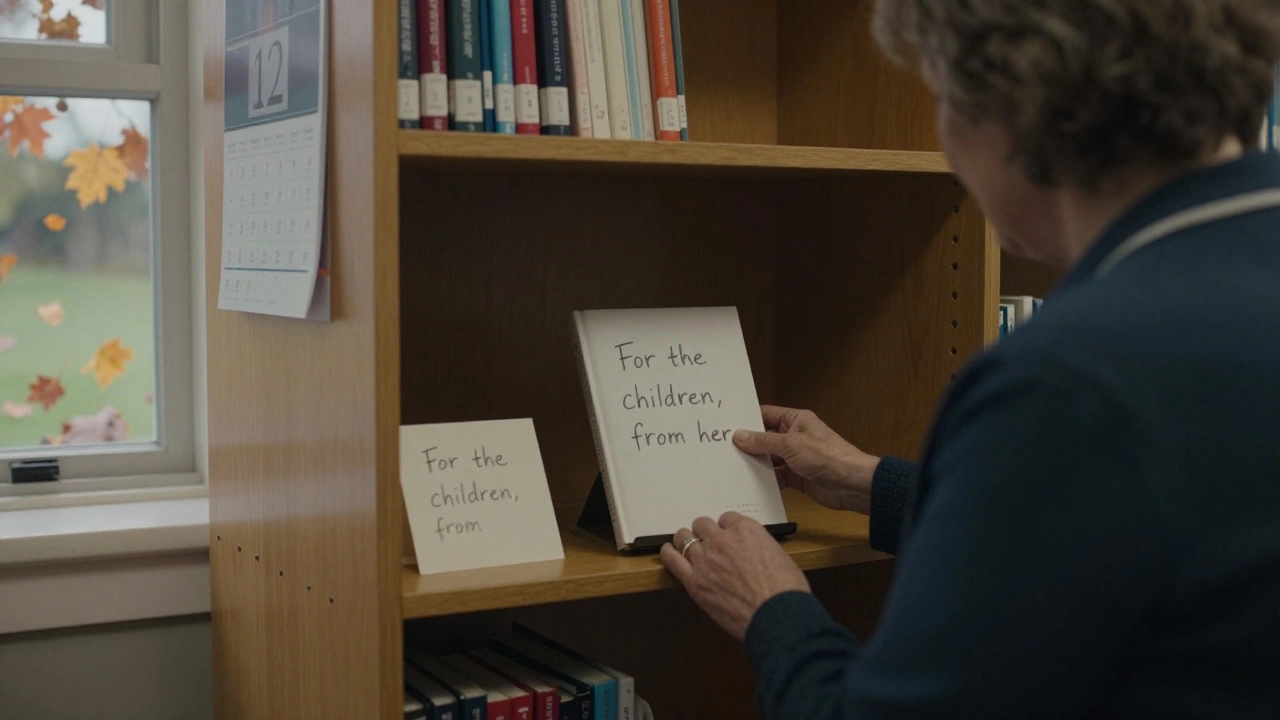

There’s a difference between donating to a big national charity and funding something you’ve seen up close. Maybe it’s the after-school program your niece attended. Or the hospice that cared for your mother. Or the community garden that turned a vacant lot into a gathering space. A charitable trust lets you fund that specific thing, exactly as you saw it need. You don’t have to fit your cause into someone else’s grant cycle. You don’t have to justify your choice to a committee. You just make it happen. One woman in Nelson set up a trust to buy books for the local library’s children’s section-every year, on her birthday. She passed away five years ago. The trust still buys those books. The librarian still writes thank-you notes to her name.

They want to inspire others

Setting up a charitable trust sends a signal. It says, "This matters enough to me to plan for it after I’m gone." That kind of action doesn’t just help a cause-it changes how people think about giving. Other families see it. Neighbors talk about it. Younger generations ask, "How did they do that?" It becomes a model. In Wellington, a retired teacher set up a trust to fund music lessons for low-income kids. Within three years, three other families in her neighborhood created similar trusts for art, sports, and coding. She didn’t ask them to. She just did it-and that was enough.

They’re tired of transactional giving

Too often, charitable giving feels like a receipt. You give $100, you get a thank-you email, a tax deduction, and maybe a tote bag. It’s efficient, but it’s also impersonal. A charitable trust cuts through that. It’s not about the immediate reward. It’s about building something that outlives you. It’s about saying, "I didn’t just want to help-I wanted to leave something behind that keeps helping." That’s why so many people who set up trusts say the same thing: "It felt right. Like I was finally doing what I meant to do all along."

It’s not just for the wealthy

You don’t need millions to start a charitable trust. Many trusts begin with $10,000 or $25,000. That’s not a luxury-it’s a commitment. A small trust can still fund a scholarship, a year of community cleanups, or a series of workshops. The key isn’t the size of the gift-it’s the clarity of the purpose. A trust set up by a couple in Taranaki with $15,000 still pays for school supplies for kids in their old neighborhood every September. They didn’t wait to be rich. They just started with what they had.

It’s a tool, not a trend

Charitable trusts aren’t new. They’ve been used for centuries. But in recent years, more people are seeing them for what they are: a practical, lasting tool for doing good. Not a buzzword. Not a tax loophole. Not a status symbol. A real way to make sure your values don’t disappear when you do. People set them up because they’ve seen what happens when good intentions fade. They’ve seen charities close. They’ve seen funding dry up. They’ve seen communities lose what mattered most. A charitable trust is how they say: "This won’t happen to mine."

Can anyone set up a charitable trust?

Yes. You don’t need to be rich. You just need to have assets you want to give away and a clear idea of how you want them used. In New Zealand, you can set up a trust with as little as $10,000. The key is working with a lawyer or trust company to draft the document correctly so it’s legally binding and tax-compliant.

How long does it take to set up a charitable trust?

It usually takes 4 to 8 weeks. Most of that time is spent drafting the trust deed-this is the legal document that spells out your wishes, who the trustees are, and how the money should be used. Once the deed is signed and assets are transferred, the trust is active. You can even set it up while you’re still alive and begin using it right away.

Are charitable trusts tax-deductible in New Zealand?

Yes, if the trust is registered with the Charities Register and meets Inland Revenue’s requirements. Donations to registered charitable trusts are tax-deductible for the donor. The trust itself doesn’t pay income tax on its earnings if it’s used solely for charitable purposes. This isn’t a loophole-it’s a legal incentive to encourage long-term giving.

Who manages a charitable trust?

Trustees manage it. These can be family members, friends, professionals, or a mix. You choose them. They have a legal duty to act in the trust’s best interest and follow your instructions. Many people pick someone they trust deeply-not because they’re financially savvy, but because they understand the cause. You can even name a professional trust company if you want expert management.

Can I change the terms of the trust later?

Generally, no. That’s the point. Once signed, a charitable trust is meant to be permanent. But if circumstances change dramatically-like if the charity you named no longer exists-you can ask a court to modify the trust’s purpose to match your original intent. This is rare, but it’s built into the system to protect the spirit of your gift.

What happens if the trust runs out of money?

If the trust’s assets are fully used up, it ends. That’s normal. Many small trusts are designed to last 10, 20, or 30 years. Once the funds are gone, the purpose is fulfilled. Some donors build in a "sunset clause" that says the remaining balance goes to another similar cause if the original one is no longer viable. Others plan for the trust to be self-sustaining through investments.

Is a charitable trust better than just leaving money in my will?

It depends. A will gives money after you die, and it goes through probate, which can take months or years. A charitable trust can start working while you’re still alive. It also gives you more control over how the money is used over time. If you want your gift to have ongoing impact, a trust is usually the better choice. If you just want to leave a one-time donation, a will is simpler.

What comes next?

If you’re thinking about setting up a charitable trust, start with this: write down exactly what you want to support. Not in broad terms like "help the poor," but specifically: "fund after-school tutoring for teens in Porirua," or "plant 500 native trees in the Tararua Range each year." Then talk to someone who’s done it before-maybe a lawyer, a financial planner, or even a trustee at a local trust. Don’t rush. This isn’t about paperwork. It’s about purpose. And when you get it right, it doesn’t just change a cause-it changes how people remember you.